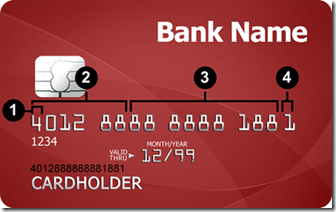

To shop online or by phone, youll need this number, along with your cards expiration date and.Card Number Tips and Tricks. Consumers, tech press, financial press and Wall Street were all intrigued for various reasons.This unique 16-digit number is printed on your Visa debit card. Illustration by Rosaleah Rautert Although phone companies, gas companies and department stores have their own numbering systems, ANSI Standard X4.13-1983 is the system used by most national credit-card systems.One of the most buzzy announcements on Apple’s stage this week was Apple Card, its in-house credit card powered by Goldman Sachs and Mastercard. The front of your credit card has a lot of numbers - here's an example of what they might mean.

Though I’m not a financial reporter, I did used to cover payments and I’m a huge points hound. For a 16-digit card, the situation is as follows: Double both numbers (starting with the first)But there are still a ton of questions around the way it works mechanically, the terms involved for consumers and its overall benefits. You cannot divide your 13-19 digit card number by ten and wait for this number to work.

Once Apple launched Passbook, it became extremely clear that it was headed towards this end game, with stops along the way for loyalty cards, coupons, external credit cards and ticketing.This week, we got to see what Apple thinks is a solid ‘version 1’ of its credit card offering. For American Express.In some ways, Apple getting into the credit card game was one of the tech world’s biggest finally’s. For VISA/MasterCard/RuPay: Use the 3-digit number from the back of your card. Enter your SBI Credit Card number.

There have been some reports that Apple Card will charge penalty rates, largely due to some required regulatory legalese. You can see signs of this in the current Apple Card animation in SharingViewService pic.twitter.com/fq7dFZV7bbThere is no penalty interest rate on Apple Card. The activation takes place with a pop up view of the card and an activation button, similar to the pairing process of AirPods.

What Is Credit Card Number How To Offer Credit

Apple Cash is not required to pay your bill, though cash back earned or any other money you have in there can go towards your balance if you desire.Apple Card does not require or display signatures. This isn’t some incredible re-imagining of how to offer credit or an intensely low interest option, but it could shift you to the bottom of a tier when you qualify instead of paying a few points higher at your ‘exact’ score.You can pay your balance via ACH from a bank account or via Apple Cash. While Apple Card’s interest rates fail to break the mold in any major way (they are roughly between 13-24%), Apple will place users who sign up at the lower end of the tier that they land in due to their credit score. It will impact your credit score, as Apple does do standard reporting, but neither Apple nor Goldman Sachs will increase your rate due to late payment.Apple will place Apple Card users at the low end of their interest rate tier. You will continue to pay your agreed upon interest rate on your outstanding balance, but that rate will not go up. Apple Card has no late fees and no penalty rates.

Card numbers are manually regenerated only, and do not automatically rotate. This is great for situations where you are forced to tell someone your credit card number but do not necessarily completely trust the recipient. But you can hit a button to regenerate the PAN (primary account number), providing you with a new credit card number at any time. This number is semi-permanent, meaning that you can keep using it as long as you want. You can use this for non-Apple Pay purchases online or over the phone. Instead, Apple provides a virtual card number and virtual confirmation code (CVV) for the card in the app.

Apple Card, though, will doubtless be the largest body of consumers to ever have easy access to a virtual card number with an easy to use interface and will expose many more people to the concept.If you use Apple Card for a subscription or ongoing service, by the way, it’s possible you’ll have to re-enter your info if you regenerate your card — though many, many retailers — especially if they have ‘Card on File’ systems already use account updater services. Several banks and credit card companies like Bank of America and Citi also offer virtual card numbers currently. This makes it even harder for someone to use your card, even if skimmed or copied, to make online purchases.I use a virtual card service called Privacy for transactions online where I don’t know the person or company that the number is going to well. Each purchase requires a confirmation code, a fantastic additional security feature outlined by Zack Whittaker earlier in the week.

And, for Apple Pay transactions, they are authenticated at the time of transaction. In the case of a non-Apple Pay transaction online — you must get your card number from the app and that is unlocked via Touch ID or Face ID, so biometrics are still in the path. If your card gets lost or stolen you can get replacement cards for free, and you can easily freeze the card with the app in case of theft or fraud.Because of the way it is set up, every purchase with Apple Card requires biometric identification aside from purchases with the physical card. You’ll only really know the last 4 digits of your PAN on the physical card. It’s important to note that the number you have in the app and the number that are on the mag stripe can be totally different and it doesn’t matter. That old number is, however, completely invalidated.The physical card has a fixed number on the mag stripe, but you don’t know what it is.

There are no foreign transaction fees, but the rate of exchange is network determined, not a fixed rate or foreign currency.Apple Card users must have two factor authentication set up to sign up.Using Apple Card on Android is pointless. For now, it’s one card per person, per account.The exchange rate for foreign transactions is determined by Mastercard. There is no fee.There is currently no provision for multiple users or shared cards. Some people were worried that the flashy titanium cards would be expensive to replace. It will just be there for you to use.Replacement cards are free.

Though some regulatory or operational partners will need to see or transmit some data, all of that must be related to operating Apple Card only, not marketing or advertising.Why cash back? There were definitely some questions that I got as well about Apple going cash back only. That goes for third parties as well. The data that they see can be used for internal reporting but cannot be used for external or internal marketing or advertising. This was on the keynote slide but there were some additional questions about it. You can’t sign up for or administrate most of Apple Card’s features on Android — but if you were to switch to Android you could continue using your physical card and paying your bill — but without the majority of the cash back or security benefits why would you?Goldman Sachs will not sell data for marketing purposes.

Portland will include trains and busses, as will Chicago. The number of vehicles and transit systems supported will vary by operator.

0 kommentar(er)

0 kommentar(er)